Canara Bank is one of the largest public sector banks in India, and it was established in Mangalore in 1906. Currently, the bank has its headquarters in Bengaluru. It was nationalized in 1963. Canara Bank was one of the first public sector banks to join the MasterCard ATM network in 2000. Over the last two decades, it has grown and spread its network all across India. Canara Bank started issuing credit cards in 2002. It offers various credit cards packed with various exciting and exclusive deals and features, as well as other banking facilities. As of June 2024, Canara Bank has over 9 lakh active credit card customers in the country. Here under are the top credit cards offered by the Canara Bank and their features and benefits, as well as the applicable charges, eligibility criteria, and required documents.

Table of ContentsCanara Bank currently has only a few credit cards in its portfolio, but all of them can be considered great for individuals who are loyal to the bank and want to start their journey with a basic Canara Bank Credit Card Only. In this article, you will find the list of best credit cards in the country as well as their detailed features and benefits:

Being one of the popular banks and card issuers in the country, Canara Bank provides its customers with some great benefits across different categories. The following are some of the general benefits that you will get with almost all the credit cards offered by the Canara Bank:

The list of the top and most popular credit cards offered by the Canara Bank is given below. You can also check their detailed features and benefits and choose a card that seems to suit you the best:

In partnership with RuPay Canara Bank has launched Canara Bank RuPay Select Credit Card. You not only enjoy the offers provided by the Canara bank but also by RuPay. The primary features of Canara Bank RuPay Select Credit card are;

Canara bank RuPay Platinum Credit card has the same features as that of Rupay Select except for insurance cover. The comprehensive insurance coverage has included the air accidental death insurance for the spouse too along with the primary cardholder. The primary features of Canara Bank RuPay Platinum Credit card are;

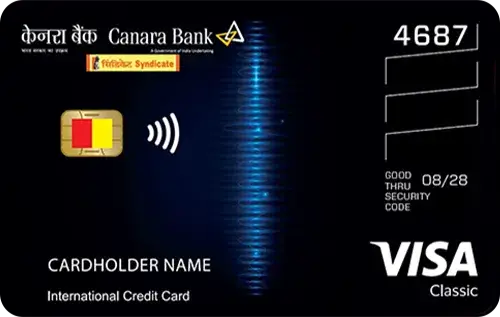

Canara Bank also issues Visa and MasterCard credit cards. Both variants offer exclusive deals and features. The primary features of Canara Bank Visa Classic/MasterCard Standard Credit card are;

Canara Bank launched Canara Corporate Credit Card to meet the requirements of the corporates providing a high cash withdrawal limit. The primary features of Canara Bank Corporate Credit card are;

Listed below is a summary of the reward benefits, travel benefits, reward redemption, applicable fees and charges, and eligibility criteria.

As discussed earlier, all the Canara Bank Credit Cards come with a different reward rate. Also, the reward rate may vary n the basis of different categories. The premium cards or the cards that come with a higher annual fee generally offer a higher reward rate as compared to the cards that come with a zero or low annual fee. In order to choose the right credit card for yourself, you should make sure that you go with a card that offers a good reward rate on the categories where you spend the most. The reward rates of the Top Canara Bank Credit Cards are mentioned in the table below:

| Credit Card | Reward Points |

| Canara Bank RuPay Select Credit Card | 2 RPs on every Rs.100 spent on this card. |

| Canara Bank RuPay Platinum Credit Card | 2 RPs on every Rs.100 spent on this card. |

| Canara Bank Visa Classic/MasterCard Standard Credit Card | 2 RPs on every Rs.100 spent on this card. |

The Canara Bank enables all the credit cardholders to easily redeem their rewards by logging into your account from www.canararewardz.com. You can redeem your accumulated reward points for purchasing goods and services, and for cashback. Canara Bank has capped the redeemable reward points for cashback at 1000 reward points and for the purchase of goods and services at 100 reward points. Also, you can only redeem your collected reward points in 3 years from the date of accrual.

| Credit Card | Reward Redemption |

| Canara Bank RuPay Select Credit Card | 1 RP = Rs. 0.25 |

| Canara Bank RuPay Platinum Credit Card | 1 RP = Rs. 0.25 |

| Canara Bank Visa Classic/MasterCard Standard Credit Card | 1 RP = Rs. 0.25 |

Other than checking the rewards and benefits of a credit card, it is equally important to look for the joining and annual of the card you are going to apply for. It is because different credit cards come with different annual charges and the features of the cards also vary accordingly. If you are someone with a high annual income, you can get any credit card you want, but if you have a low or average income, you should look for affordable credit cards that come with a lower annual fee. You can go through the joining and annual fee of the popular Canara Bank Credit Card via the following table:

| Credit Card | Joining fee | Renewal Fee | Spend-based Waiver |

| Canara Bank RuPay Select Credit Card | NIL | NIL | NA |

| Canara Bank RuPay Platinum Credit Card | NIL | NIL | NA |

| Canara Bank Visa Classic/MasterCard Standard Credit Card | NIL | NIL | NA |

A lot of people think that only the annual fee is important to be checked while looking for the best credit card for them, but it is not really a good idea. There are a lot of other factors and charges that should be considered. Other than the annual fee, the following are some of the important fees 7 charges that are associated with Canara bank Credit Cards and must be checked before getting a card:

| Interest Rate | 2.5% per month or 30% per annum |

| Cash Advance Fee | 3% of the withdrawn amount (subject to a minimum of Rs. 30 on every withdrawal of Rs. 1,000) |

| Forex Markup Fee | 3.5% of the transaction amount |

The Canara Bank has specified different eligibility criteria for every credit card. These criteria depend on various factors including the applicant’s age, income, credit history, relationship with the bank, residential status, etc. Though the age requirements are almost the same for all cards, the income requirements and other factors may vary to some extent. In order to get a credit card from the Canara Bank, you will have to fulfill the eligibility criteria as mentioned below:

For more information about Canara Bank’s credit card eligibility requirements, visit this page.

While applying for a Canara Bank Card, you will also need to submit a few essential documents like identity proof, address proof, proof of income, etc. Therefore, you must make sure that you carry all these documents with you before going to apply for a card. The detailed list of required documents is given in the following table:

To apply for Canara Bank credit cards you need to visit the nearest Canara Bank Branch with all the required documents and fill in the application form there and submit it at the branch. You can also download the application form from the bank’s official website and after filling it out and attaching the required documents you can submit it to your nearest branch. It will save your time waiting at the branch as you can just go, submit the form, and come back. The application form can be downloaded in English as well as Hindi at your convenience.

If you have already applied for a Canara bank Credit Card, you can check the status of your application easily by contacting the bank’s customer care or by visiting your nearest Canara Bank branch. Just ask the bank officials about your application status and provide them with the required details, like your application number, PAN Card number, etc. They will let you know the status of your application in a few seconds.

For more ways to check your Canara Bank Credit Card application status, click here.

There are a lot of ways in which you can activate your Canara Bank Credit Card after you receive it. Following are some of the popular ones:

For more ways to get your Canara Bank Credit Card activated, click here.

The Canara Bank customer support is available 24*7. If you have any queries regarding credit cards or any other personal banking you can call on the toll-free numbers;