Learn how top nonprofits use Classy to power their fundraising.

Published July 5, 2023 • Reading Time: 5 minutesJust as people expect a receipt when they purchase an item from a store, your supporters expect a donation receipt when they donate to your nonprofit organization . Clear and consistent nonprofit donation receipts help build trust with your donors .

These also help keep your bookkeeping organized, creating greater financial transparency. Plus, your nonprofit must send donation receipts to maintain its status as a tax-exempt organization .

Streamlining and automating the process of formatting and sending donation receipts can help your nonprofit grow by redirecting the time spent on these financial admin tasks to amplifying your mission. To help make that more achievable, you’ll need to know the basic requirements of donation receipts and how to make yours stand out.

Below, we cover everything you need to know about creating a donation receipt letter for tax purposes .

A donation receipt is a written acknowledgment to your donor of their contribution to your cause. In addition to showing donor appreciation, these messages help your supporters file their annual income tax return deductions and help your charitable organization keep good internal records of gifts.

While every donation receipt serves the same purpose, there are a few formats you might send based on the type of donation , such as cash donations versus donated items . These are the five main donation receipt categories:

The Internal Revenue Service ( IRS ) has specific legal requirements for when to send donation tax receipts . 1 Always check the IRS website for the latest nonprofit requirements. In general, these scenarios include:

These requirements apply to all donations, regardless of whether a supporter provided their gift in cash, stocks, or in-kind support. Failing to send donation receipts in these instances can cost your nonprofit a penalty of $10 per donation and up to $5,000 for a single fundraising campaign.

While these situations require nonprofits to send charitable donation receipts , it’s best practice to send them for all donor contributions. Following this process keeps your nonprofit more organized and ensures ongoing compliance. Plus, you don’t have to print these receipts —you can share and store them electronically as long as you send them to the donor.

Your donation receipt can be a mailed thank you letter or an emailed acknowledgment. Select a process that works best for your nonprofit. For example, you may consider emailing receipts for individual donations supporters make throughout the year, then mailing a more formal end-of-year donation receipt that totals their contributions.

When writing your donation receipts , customize them to continue to tell your nonprofit’s story. Keep these four steps in mind during the process:

Even though nonprofit donation receipts can look different, there are legal requirements for specific elements you’ll need to include. You should always have the following information on your donation receipts :

Note: Religious organizations don’t have to describe or assign value to intangible religious benefits .

Those are the basics, but you can take your receipts to the next level by adding a few other elements. Here are a few ideas to get you started:

The IRS should always be your number one source of information for the latest requirements on donation receipts , but here are a few answers to frequently asked questions.

Yes. The IRS may not check every individual donation receipt , but it’s best to operate as if it does. You want to be ready if the IRS decides to check your records.

Incomplete records could mean disqualification of your tax-exempt status , and you don’t want to cause any frustration for your donors over an easily correctable mistake.

Yes. First, craft the outline of your donation receipt with all the legal requirements included. Then, you can customize this basic template based on donation type, such as noncash contributions or monetary support. Just be sure to review your donation receipt templates annually to make any necessary updates.

As long as you send a recurring donor an end-of-year donation receipt with the total amount of their gifts from that year, you don’t need to send them a receipt every month. However, this doesn’t mean you shouldn’t. Ask your donor if they’d prefer to receive the monthly receipt in addition to your year-end statement.

If you don’t send monthly receipts, plan to send an initial thank you receipt at the start of a donor’s participation in recurring giving and each anniversary afterward. Share how much you appreciate their ongoing support and that, while they shouldn’t expect a monthly receipt, they can expect monthly updates about your work.

Donation receipts are a crucial part of your nonprofit’s operations and administration. These communications help with donor retention through heightened donor trust and support your organization’s recordkeeping .

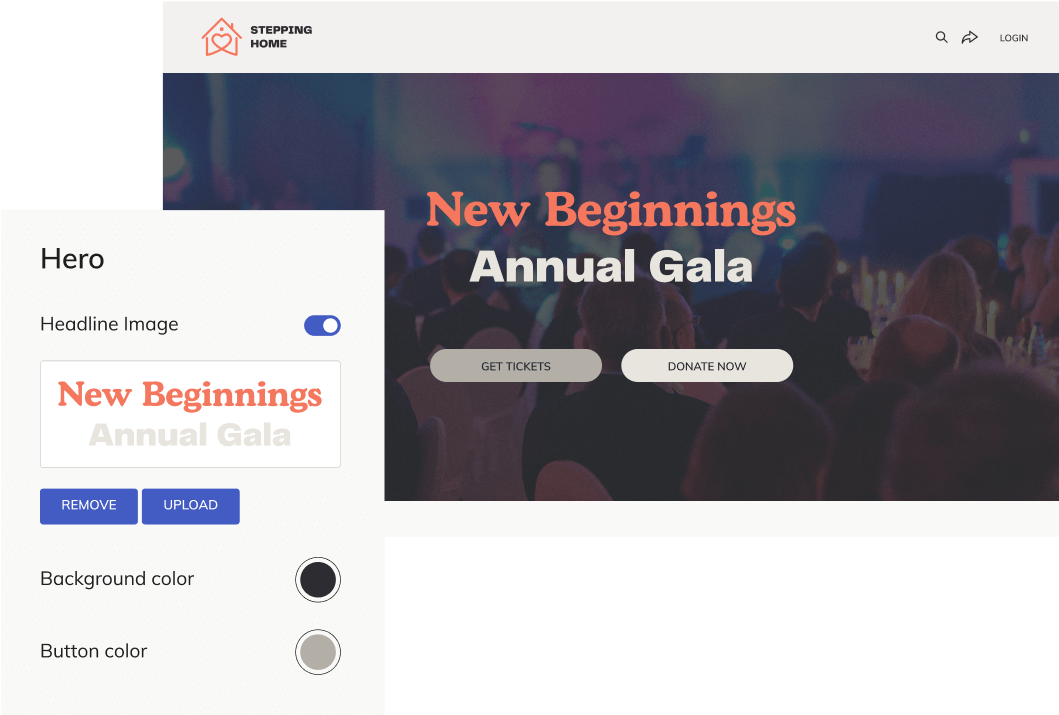

Classy helps make the donation receipt process easy. Once supporters submit their donation form , they’ll receive an automated email with their donation information that thanks them for their support. This helps free up your time to keep doing the critical work your donors want to see. You can also customize the appearance and messaging of your donation receipts using Classy’s content blocks and other email features .

Article Source

1. “ Charitable Contributions : Substantiation and Disclosure Requirements,” Internal Revenue Service, last modified March 2016, https://www. irs .gov/pub/ irs -pdf/p1771.pdf .

Explore Simple Donation Websites